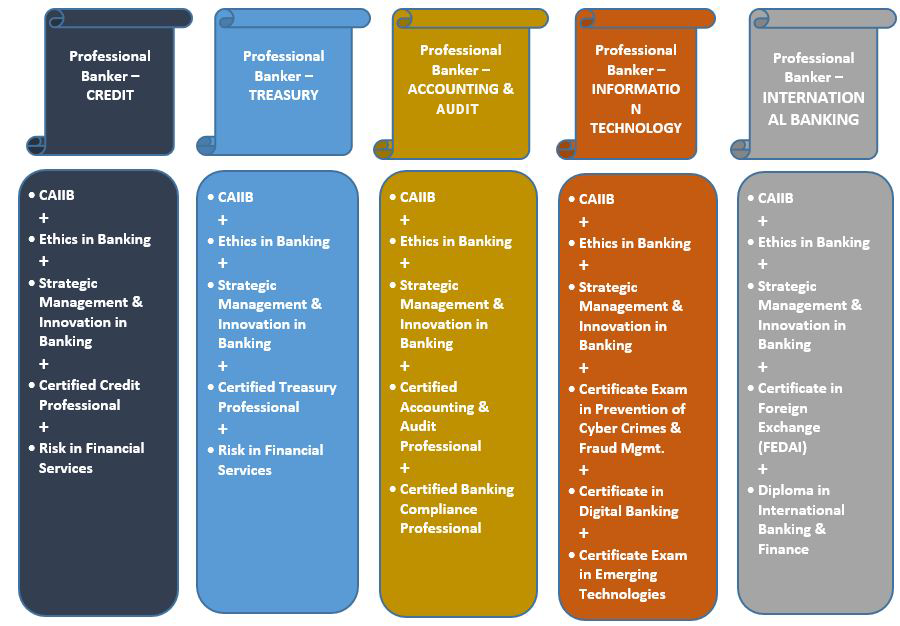

Career beyond JAIIB and CAIIB with IIBF Certification Courses

Certified Credit Professional (CCP): Ideal for those aiming to excel in credit appraisal and related functions, CCP certification provides a deep understanding of credit risk assessment, management, and monitoring. With banks increasingly focusing on prudent credit practices, holding a CCP certification can lead to roles such as Credit Analyst, Risk Manager, or Credit Underwriter. It showcases a candidate’s ability to evaluate creditworthiness and manage credit risks effectively, making them invaluable assets for financial institutions.

Certified Treasury Professional (CTP): The CTP certification caters to individuals involved in treasury operations, equipping them with specialized skills in liquidity management, cash flow forecasting, and risk hedging strategies. As treasury management becomes crucial for optimizing financial performance and managing market risks, professionals with a CTP certification are highly sought after across various sectors. This certification not only enhances understanding of treasury functions but also demonstrates expertise in maximizing returns on investments and optimizing liquidity.

Certified Information System Auditor (CISA): In an age where cybersecurity threats pose significant challenges for financial institutions, the CISA certification is invaluable for professionals engaged in information security and audit functions. By providing knowledge of IT governance, risk management, and information security auditing, this certification validates individuals’ ability to safeguard sensitive data and mitigate cyber risks. With regulatory authorities increasingly emphasizing cybersecurity compliance, holding a CISA certification can greatly enhance career prospects in roles such as Information Security Officer, IT Auditor, or Cybersecurity Analyst within the banking sector.

Certified Anti Money Laundering Expert (CAME): Addressing financial crimes like money laundering and terrorist financing is a top priority for banks worldwide. The CAME certification equips professionals with the skills to identify, prevent, and mitigate money laundering risks effectively. By understanding anti-money laundering regulations, transaction monitoring techniques, and suspicious activity reporting, individuals with a CAME certification can pursue fulfilling careers in compliance, risk management, or forensic investigation within the banking sector. Moreover, in an era of heightened regulatory scrutiny, this certification demonstrates commitment to upholding the integrity of the financial system.

Conclusion: While JAIIB and CAIIB certifications remain crucial qualifications for banking professionals in India, exploring additional certification courses offered by the IIBF can significantly enhance career growth. Whether it’s gaining expertise in credit management, treasury operations, information security, or anti-money laundering practices, each certification validates specialized skills and industry knowledge. By staying updated with emerging trends and acquiring relevant certifications, banking professionals can position themselves as valuable assets in a competitive landscape, unlocking new opportunities for career advancement and professional development.

Tag:banking exam, CAIIB, iibf, JAIIB